What we look for

We fund high potential organizations that have the capacity to scale innovative tech-enabled solutions for maximum social impact.

Our selection criteria include:

- Social impact sectors: Fit within one or more of our priority social impact sectors: crisis/critical human needs, education, economic empowerment, and climate regeneration.

- Technology: We direct funding toward solutions that apply technology to deliver programs and services, and/or support organizational insights and operations - to connect the unconnected and close the digital and data divide.

- Replication: We look for solutions that can be replicated beyond the initial geography in which they are developed and implemented.

- Scale: We aim to support solutions that have potential for scale.

- Impact: We fund organizations that have a commitment to tracking progress, validating impact, and reporting transparently.

- Market demonstration and ecosystem impact: We look to support solutions that demonstrate market potential and/or will have result in ecosystems level impact.

- Organizational capacity and proximity: We look for organizations with strong management capacity, inclusive teams, and that are proximate to the communities they are supporting.

- Viability: We aim to support organizations and solutions that can be financially viable, and to ensure sustained impact beyond our lifecycle of engagement.

Types of funding

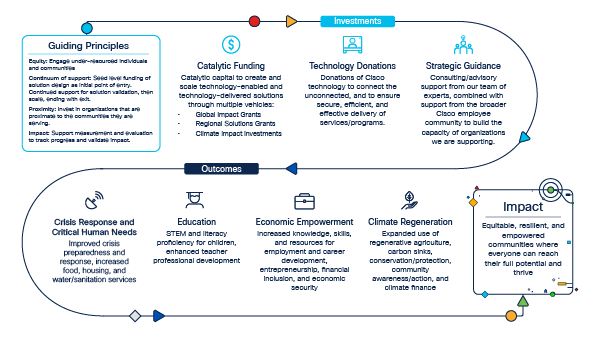

We bring the best of Cisco to our partners through a mix of funding, technology, strategic guidance, and employee volunteerism.

Cash grants and impact investments

- Our unique investment model is designed to fill a critical gap in funding for high-potential organizations – identifying those with early-stage, tech-enabled solutions that we believe have the potential to scale exponentially and deliver extraordinary impact across our four priority social impact sectors.

- Global Impact Grants (GIG): Funding to non-profits leveraging technology to deliver programs and opportunities that can be replicated and scaled at a country, regional, and/or global level. Learn how to apply.

- Habitat for Humanity grants: providing support to build homes for families in need around the world. (By invitation only)

- To learn more about our grantee partnerships, meet our current partners and then explore blogs on their impactful work.

Cisco technology grants

- Technology Grant Program (TGP): Awarding Cisco’s best-in-class technology to qualifying nonprofits. Learn how to apply.

Strategic and technical advisory services

We also offer strategic and technical advisory services from Cisco’s global employee community. These pro-bono consulting services support our partners across a range of areas, from solution design and testing, to security, governance, strategy, organization structure, marketing, and more. Advisory services are provided via both 1:1 consulting and by teams.

Employee volunteerism

Employees may also volunteer their time for individual and group volunteering as needed.

Measuring social impact

Accurately measuring progress and validating true impact are core to how we support our partners and drive exponential social value.

We work collaboratively with our partners to jointly establish key performance indicators and associated targets; support data collection, analysis, and validation; and provide advisory services and other support to enhance impact evaluation capabilities.

Together, we track various levels of impact including individual impact, community/ecosystem impact, and organization impact including:

- Social impact on individuals, communities, and ecosystems for each of our priority social impact sectors.

- Replication of solutions beyond initial geography

- Scale of reach and engagement

- Financial viability and additional funding secured

In 2016, Cisco set an ambitious goal to positively impact 1 billion people around the world through our Networking Academy initiative and Global Impact Grant program. In December 2023, we were thrilled to share that we exceeded our goal – more than a year earlier. Learn more about how we impacted one billion lives.