Tax Requirements

Make sure that you select the proper tax form for the Cisco entity with which you will do business, if applicable, and submit the tax form electronically with your completed GSEP to your Cisco representative.

United States (Suppliers Doing Business with Cisco, Inc., and Its U.S. Affiliates)

Cisco, Inc., and its U.S. affiliates (“Cisco") are required to obtain and maintain complete, up-to-date, and accurate tax documentation from its suppliers to comply with U.S. tax withholding and reporting obligations, as directed by the U.S. Internal Revenue Service (“IRS").

Each organization in any location that serves as a supplier to Cisco, Inc., or its U.S. affiliates must provide Cisco with the appropriate U.S. tax documentation. You must provide Cisco with an appropriate IRS form (Form W-8BEN, W-8ECI, W-8EXP, W-8IMY, or W-9) based on your residency and entity classification for U.S. tax purposes. Your enrollment package will not be processed until you have provided the complete and correct tax documentation.

For your convenience we have provided links to these forms and their instructions on the IRS website. We have also provided a brief explanation of the forms in IRS Tax Forms.

If you are a U.S. supplier, you need to submit the following form: ![]()

Question inquiries: 1099_inquiry@cisco.com

If you are a non-U.S. resident supplier, complete one of the following forms: ![]()

| Form | W-8BEN | Instructions: | http://www.irs.gov/pub/irs-pdf/iw8ben.pdf |

| Form | W-8BEN-E | Instructions: | http://www.irs.gov/pub/irs-pdf/iw8bene.pdf |

| Form | W-8ECI | Instructions: | http://www.irs.gov/pub/irs-pdf/iw8eci.pdf |

| Form | W-8IMY | Instructions: | http://www.irs.gov/pub/irs-pdf/iw8imy.pdf |

| Form | W-8EXP | Instructions: | http://www.irs.gov/pub/irs-pdf/iw8exp.pdf |

Michelle Abbott

Cisco, Inc.

7025-4 Kit Creek Road

PO Box 14987

RESEARCH TRIANGLE PARK, NORTH CAROLINA 27709-4987

Question inquiries: miabbott@cisco.com

Canada (Suppliers Doing Business with Cisco All Canada Entity and Its Affiliates)

Withholding tax regulation

Cisco Systems Canada Co. (Cisco) is required to withhold 15 percent tax on all payments to non-resident suppliers for services rendered in Canada under of the Canadian Income Tax Act. An additional 9 percent tax is required if the services are rendered in the province of Quebec. The withholding tax applies to services only and not to the sale of goods or the reimbursement of expenses, such as travel expenses, where no profit is earned. Please see the supplier FAQs below for further information.

Canada Tax FAQ (English) | Canada Tax FAQ (French) ![]()

Please direct any further questions/inquiries to t4a_inquiry@cisco.com.

China (Suppliers Doing Business with Cisco All China Entity and Its China Affiliates)

Withholding tax regulation

Cisco all China entities and its' China affiliates ("Cisco") are required to obtain and maintain complete, up-to-date, and accurate payment documentation from its suppliers to comply with China withholding tax and reporting obligations as directed by the China tax government. The scope is for all foreign currency service invoices.

Each organization in any location (out of China mainland area) that serves as a supplier to Cisco China entity or its' affiliates must provide Cisco with the appropriate payment documentation. You must provide Cisco with "Statement of Work", "Purchase Order" and "Invoice", both English and Chinese version (Remark: the each of invoice amount is better lower than USD 30K, if above this threshold, the additional documents will be required by tax authorities, such as WHT clearance certificate application form and non-resident's claim form, other documents may be required by different tax authorities and different service types) for China withholding tax purposes. Your enrollment package will not be processed until you have provided the complete and correct tax documentation.

Just to give you an idea how complex and time-consuming the withholding tax process in China, we share the withholding payment procedure here.

Process for China Withholding Tax

- If the Cisco PO requestor chooses a service category of purchasing, he needs submit required documents for overseas payment purpose. Required documents are: Statement of Work, Purchase Order and Invoice, both English and Chinese version.

- Cisco AP and Tax teams determine whether the invoice is subjected to Withholding Tax (WHT) or not. If the invoice is not subjected to WHT, AP will make the payment base on Customs clearance certificate directly. If the invoice is subjected to WHT, the following steps are needed to be followed.

- Cisco AP collects all the related documents. Tax team reviews all the documents.

- Cisco AP submits all documents to tax authorities. Tax authority determines the rate. If Tax authority has further requirement on documents, they will feedback to Cisco.

- Cisco AP calculates the WHT amount according to tax officer's advice. After internal review and approval, Cisco AP/Tax files the WHT return. AP also processes payment by sending the authorized tax voucher to bank for final payment.

- Cisco AP makes the USD payment base on the tax payment receipt

Cisco China invoice management regulations

In order to receive timely payment for the goods or services, please strictly follow the below Cisco's invoice management regulations:

- Integrity and accuracy for invoice information: Please ensure the integrity and accuracy of the invoice contents, including the amount, description of goods or services, quantity of goods or services, invoice title and other information.

- Post invoice, to ensure we can receive your invoice timely, please choose the correct billing address from the Cisco AP web site.

- Payment only can be made base on a valid invoice. To ensure the on time payment, please send invoice to Cisco AP team timely and better to submit the invoice within 1 month from the invoice date.

- Cross year invoices will be rejected unless you are following the notice for year-end closing period from Cisco. We will send out the unified notice at the end of year to clarify the invoice submitting date.

Central and South America (Suppliers Doing Business with Latin American Cisco Entities)

If you are working with one of the following Cisco entities, make sure that the applicable Anexo Tributario document is completed:

Korea (Suppliers Doing Business with Cisco All Korea Entity and Its Korea Affiliates)

Withholding tax regulation

Cisco all Korea entities and its' Korea affiliates ("Cisco") are required to obtain and maintain complete, up-to-date, and accurate payment documentation from its suppliers to comply with Korea withholding tax The scope is for all service invoices provided by foreign suppliers

Each organization in any location (out of Korea) that serves as a supplier to Cisco Korea entity or its' affiliates must provide Cisco with the appropriate payment documentation. You must provide Cisco original document of "Statement of Work", "Purchase Order" and "Invoice", for Korea withholding tax purposes. Your enrollment package will not be processed until you have provided the complete and correct tax documentation.

Just to give you an idea how complex and time-consuming the withholding tax process in Korea, we share the withholding payment procedure here.

Process for Korea Withholding Tax

- If the Cisco PO requestor chooses a service category of purchasing, he needs submit required documents for overseas payment purpose. Required documents are: Statement of Work, Purchase Order and Invoice

- Cisco AP and Tax teams determine whether the invoice is subjected to Withholding Tax (WHT) or not. If the invoice is not subjected to WHT, AP will make the payment:

- base on Customs clearance certificate if invoices are billed for product only

- if services are performed outside Korea

- if the invoices is subjected to WHT, the following steps are needed to be followed:

- Cisco AP collects all the related documents for Tax team review, tax team confirm the percentage of WHT or payment amount for tax office.

- Cisco AP book two records as "check" for tax office payment (using systems exchange rate)and processes remaining payment to vendor except for withholding tax amount by sending all documents to bank for payment. If bank has further requirement on documents, they will come back to Cisco

- Cisco AP submits all softcopy of documents to local payroll team who will process withholding tax payment to tax office.

- Local payroll team sends payment slip to AP Team.

All Other Entities (Suppliers Doing Business with Cisco Asia Pacific, Europe, Middle East, and Africa Entities)

No additional information is needed.

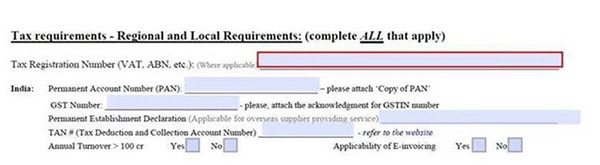

India (Suppliers Doing Business with India Cisco Entities)

Tax Account Number Regulation

Per new India government regulations, all India entities will be required to transition from physical to e-invoices before October 1, 2020. New suppliers will need to declare the transition to e-invoicing on the GSEP form as part of the supplier onboarding process.

E-Invoicing

Invoice Regulations Cisco all India entities will be required to transition from physical to e-invoices before October 1, 2020. New suppliers will need to declare the transition to e-invoicing on the GSEP form as part of the supplier onboarding process.

If you are an existing supplier or have any questions related to this regulation, please direct inquiries to indtan@cisco.com.