The Journey to Cloud Network Management for Financial Services White Paper

Available Languages

Bias-Free Language

The documentation set for this product strives to use bias-free language. For the purposes of this documentation set, bias-free is defined as language that does not imply discrimination based on age, disability, gender, racial identity, ethnic identity, sexual orientation, socioeconomic status, and intersectionality. Exceptions may be present in the documentation due to language that is hardcoded in the user interfaces of the product software, language used based on RFP documentation, or language that is used by a referenced third-party product. Learn more about how Cisco is using Inclusive Language.

The evolution of network management in financial services

A network management revolution is underway in financial services. It’s being driven by the move to hybrid work by many institutions in a competition for talent, along with the use of Artificial Intelligence and Machine Learning (AI/ML), data analytics, and other advanced technologies. Financial services firms are faced with a myriad of challenges, including creating competitive customer experiences, using data for new efficiencies and to uncover opportunities, ensuring cybersecurity and data governance, and introducing and monitoring sustainable practices. Beyond corporate offices, branches with different types of networked devices and mobile apps require low latency and different approaches to security.

These changes are putting massive stress on the network and the teams that support it, threatening the foundation for future technology and business innovations. IT teams in financial services companies are tasked with ensuring the network is ready for these challenges today with an eye toward supporting the challenges of tomorrow. Network operations teams are facing this head-on as they drive new trends to support a more mobile, diverse, and data-hungry base of users and devices.

These shifts can be categorized as automation and analytics, as-a-service consumption of technology, IoT, and security. Each of them plays into the others and creates a need for simplicity, resiliency, and agility in the network.

This white paper outlines these trends and presents a scaling IT operating model as a path toward helping financial service IT organizations address the opportunities and challenges of hybrid work and advanced digital and networking technologies.

Cisco sees several factors facing IT organizations in financial services that are building out the network for the future. These highlight how IT organizations are working differently to deliver applications faster and support new devices, without compromising security.

The company-wide financial services network is increasingly complicated, with a diverse set of devices, ways of connecting, and locations to connect from. It’s no longer just laptops and cell phones; everything is connected, from tablets and cameras to kiosks and digital signage. To securely connect these devices while providing an exceptional experience, network operations teams are starting to rely on automation and AI/ML to simplify network operations and manage all branches or other locations from a central location.

Automation replaces repetitive, manual tasks with software, reducing time and labor, for lower operational costs. Analytics provide insights and actionable information by analyzing large volumes of data. By making data-driven decisions, financial services organizations can optimize processes, allocate resources more efficiently, and reduce operational inefficiencies and costs.

What does this mean for financial services IT? The ability to deploy networks faster with provisioning and configuration automation. To proactively scale the network using deep insights into capacity and performance. To improve time-to-resolution with AI diagnostics and remediation.

To accommodate the huge increase in hybrid work and mobile meetings, automation allows network operations teams to do much more than manage the basics of identity and policy. These teams can now also harness network telemetry and automate identity and policy management using AI/ML models, accelerating their understanding of whether the user is who they say they are and whether they are visiting from a safe network. To do this effectively, the network needs to be agile, flexible, and ubiquitous.

Going from installing and managing infrastructure as a reaction to business demands, with a focus on managing infrastructure costs, financial services IT has an opportunity to be proactive and take advantage of cloud-based as-a-service consumption models. With the cost structure of as-a-service technology, financial services companies have the flexibility to swiftly open new branches and introduce innovative apps and services. Services can be scaled based on outcomes. New capabilities can be easily added. As-a-service consumption helps shift IT efforts away from cost reduction toward activities that effectively contribute to profit.

The proliferation of remotely accessed devices, assets, and sensors in both indoor and outdoor environments is accelerating. Cisco research highlights that by 2023, IoT devices will make up half of all networked devices (up from a third in 2018).[1] Financial services organizations are looking at IoT as the answer to a wide range of challenges and opportunities. For example, some institutions are focusing their customer experience efforts not only in digital channels, but by creating smart branches that take personalized customer interactions to new levels. They include using cloud-connected cameras for surveillance and to understand lobby waits and vault visit times, kiosks for check-ins to speed up services, and digital signage that addresses each consumer’s personalized needs as they pass by. This influx of devices in financial services organizations of all kinds will drive a further convergence between IT and Operations Technology (OT) teams. In a bank branch, for example, the operations team in charge of power, lights, HVAC, and other functions relies heavily on network connections. Going forward, IT and OT teams will need to collaborate and share intelligence on network and device health, frequency band usage, security, policy, and maintenance efforts. This requires a data-driven and mobile network.

The complexity of mobility, a heterogeneous device base, and IoT means IT is thinking differently about security. IT teams understand that security cannot be a guarded perimeter around the network. From the office to the coffee shop, and from the laptop to the connected security camera, security must permeate everything in the network.

Network access is available 24 hours a day seven days a week, globally. Network operations teams need to be able to react to security threats at any point of the day or night, wherever they are. Immediate access to the network, whether an administrator is on-premises or at home, is imperative.

Financial services firms have the added responsibility of safeguarding sensitive customer information—from personal identifiers to account numbers. Breaches can cost institutions millions to billions of dollars and threaten their continued existence.

These trends are creating a renewed need for simplicity, resiliency, and agility in how network operations teams at financial services organizations manage the network. To achieve these features, many are moving to cloud management for the network. Moreover, the transition is already underway, with three in five enterprises reporting the use of some level of cloud-based platform to manage network infrastructure.[2] A recent study[3] found that 62% of leading financial services companies believe they will gain future revenue with cloud technologies. Another 52% think this revenue will be pivotal in their future profitability.

One use case that brings to light the interplay of these trends and the resulting need for cloud network management is the growth of hybrid work.

The pandemic started a significant cloud push at the application level, with 70% of organizations reporting that it accelerated the migration of apps to the cloud.[4] This was a matter of business survival as workers moved to remote work and needed access to collaboration and productivity tools. However, the use of cloud in the application layer has not abated, with one Gartner study claiming that by 2028, cloud-native platforms will serve as the foundation for more than 95% of new digital initiatives — up from less than 50% in 2023.[5]

To enable these cloud applications to function effectively regardless of location or device, the network needs to be more mobile, agile, and optimized for remote access. This is imperative in financial services, where a war for talent is underway. (A recent study[6] found that the hardest IT skills to acquire are individuals with AI/ML, cybersecurity, data science, and data analytics experience.)

Research from Enterprise Management Associates shows that 85% of organizations across industries are experiencing a permanent increase in the number of employees working from home at least part time.[7] What’s more, people aren’t just working from their laptops anymore—Cisco data shows a 200% increase in meetings accessed from mobile devices.[8]

As people return to the office in a hybrid fashion, employers are grappling with how they can help employees feel safe and how they can manage the costs of an emptier building. And IT is implementing changes to deliver applications quickly, automate policy management, and secure workers wherever they may be. With network operations employees being largely hybrid themselves, financial services IT organizations have a complicated set of considerations that drive the trends outlined earlier.

Trends driving migration to the cloud in financial services

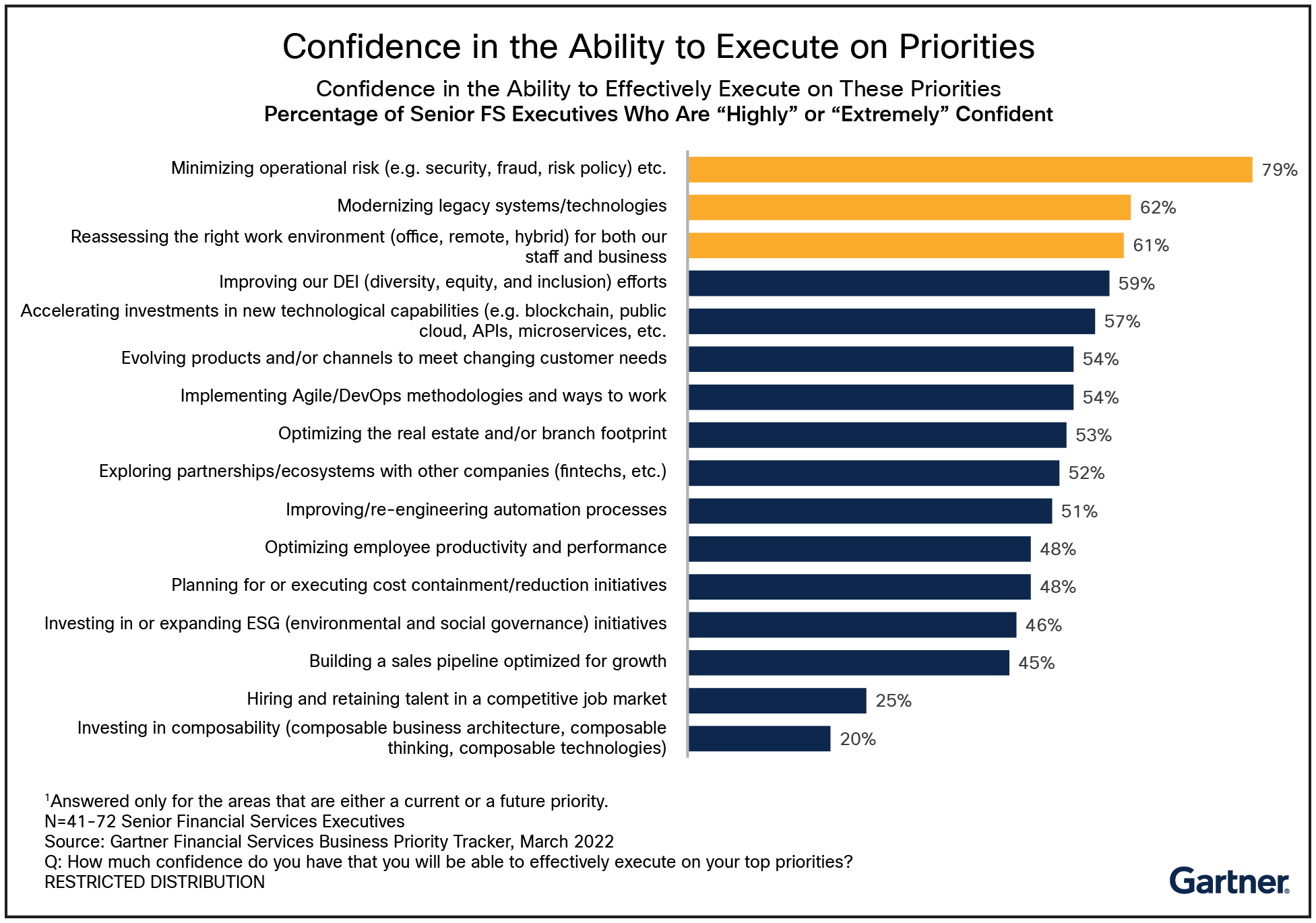

In a Gartner study[9], only 25% of financial services executives had confidence in their organization's ability to hire and retain talent in a competitive job market. And just 20% had confidence in their ability to invest and develop a composable business architecture—an organization made from interchangeable building blocks—to support the thinking and decisions related to hiring and talent retention. The modular setup of composable business architecture enables organization to rearrange and reorient as needed depending on external or internal factors, like shifts in customer expectations, and new technological opportunities to drive new revenue.

This is where cloud comes in. IT organizations need the right blend of networking technology, simplicity of management, and operational agility to deliver hybrid work, great customer experiences, and modular building blocks to provide composable solutions at scale. Networking teams are implementing cloud network management to:

● Enable remote monitoring and/or management.

● Support cross-network automation to provide real-time diagnostics, automated onboarding, and policy management.

● Collect data across the network from user devices and IoT sensors to speed up decision making.

All in all, networks require high levels of adaptability and simplicity, and the ability to securely connect and support users regardless of their location. This circles back to the earlier trends and highlights the need for cloud networking now.

What is cloud network management?

To address these challenges in the financial services industry and adapt to the requirements of a more distributed workforce, organizations are rapidly adopting network management platforms in the cloud. Cloud network management not only removes the need for a physical network management device on-premises, it also helps financial services IT organizations evolve their operations to meet these new requirements head-on.

With cloud management, IT can monitor and manage complex networks from anywhere. To dive deeper into how this capability affects the trends guiding networking in financial services, it’s worth taking a closer look at cloud monitoring and management.

Cloud monitoring provides more than just a view of the networking environment in a centralized dashboard. Network operations can use cloud monitoring to gather and analyze networking statistics (such as traffic information) and configurations (such as connected ports) and perform basic troubleshooting from 10 meters or 100 miles away.

One of the first benefits users of cloud monitoring realize is access to network data at scale. Cloud monitoring of networks connects the switching and access infrastructure to a centralized dashboard to which data is funneled, allowing IT organizations to make decisions faster and serve as the backbone for any automation efforts.

This access to data also speeds up issue resolution. A network administrator can identify switch connection troubles and start mitigating the impact from anywhere on the planet. This is increasingly important as more switches are being deployed to support trends such as IoT with Power over Ethernet (PoE)-powered lighting and to pull data from IoT hubs to a centralized dashboard.

Cloud monitoring is often a first step toward full cloud management, as it allows networking operations teams to experience the benefits of cloud without having to replace their existing on-premises management system.

Cloud management takes cloud monitoring and adds a high level of flexibility and agility for network operations teams in financial services organizations. The centralized dashboard can be used to remotely manage onboarding, identity, port configuration for switches, analytics, and security without the cost and complexity of on-premises wireless controllers and overlay management systems. The data collected from the network can also be used to fully automate these processes with automated security alerts and zero-touch provisioning of devices.

The ability to manage large financial services networks with dozens, hundreds, or thousands of branches and tens of thousands of endpoints from a central hub enables IT teams to take full advantage of the networking trends outlined earlier. In fact, almost 700,000 Cisco customers across myriad industries manage their network at least in part from the cloud.

Flexibility in how cloud is consumed is another benefit. Cloud network management (including monitoring) is an as-a-service offering. Financial services IT organizations can take advantage of cloud network management without the upfront costs of an on-premises solution. In addition, it can be easily scaled based on the needs of the organization and is always up to date with the latest features and security.

The Cisco full-spectrum IT operating model

The Cisco full-spectrum operating model

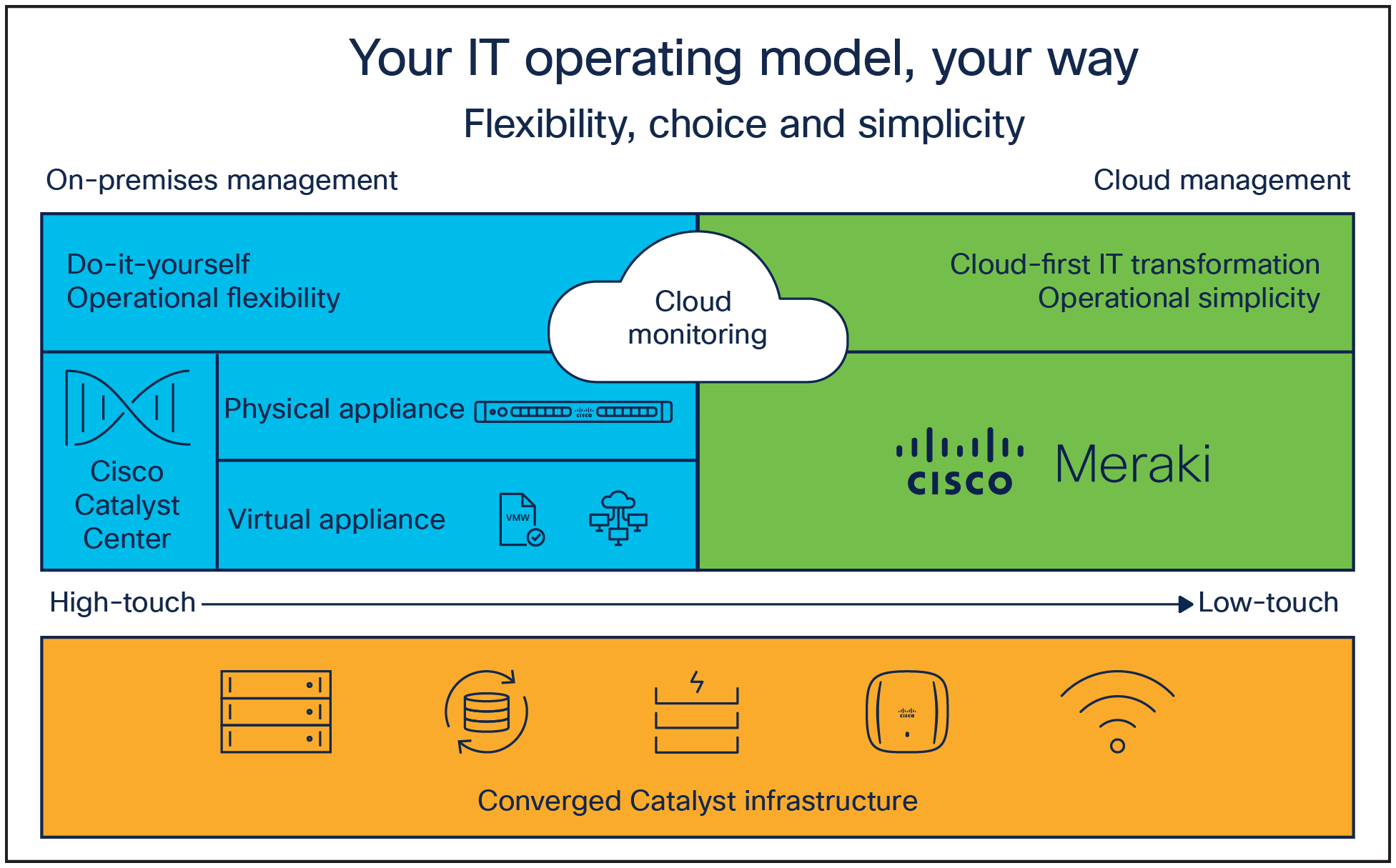

Cisco offers a unified approach to cloud networking management to support everything from air-gapped, on-premises network management to fully cloud-managed networks. The goal is to meet network operations where they are in their cloud journey.

This approach unlocks a vast expanse of opportunities for financial services IT organizations, all of which are built on trusted, known Cisco platforms that provide a consistent experience regardless of the use case.

Cisco is investing in on-premises and cloud management for today’s challenges, with an eye toward what customers across industries will need for tomorrow.

A (virtual) on-premises operating model

While cloud enables new use cases and improves simplicity, not all networks can be hosted in the cloud today.

Cisco understands these needs and is continuing to invest in the on-premises network management platform, Cisco Catalyst Center. The newest innovation from Cisco in on-premises network management is the Catalyst Center virtual appliance.

Catalyst Center traditionally resides on a physical appliance. The Catalyst Center virtual appliance eliminates the need for this hardware and deploys Catalyst Center in a public cloud service, such as AWS, or in a VMware ESXi virtual environment. It can be located on-premises or in a colocation facility and provides feature parity with the physical appliance.

The journey to cloud-first IT transformation

As outlined earlier, the cloud-managed network transformation is already underway. IT organizations want to engage in the trends guiding networking, and this can’t always be achieved with the existing network infrastructure. Cisco understands this and is building the future of the network today by bringing together the Cisco Meraki cloud platform with Catalyst hardware. This will be a scalable platform to support IT as they embark on the journey from on-premises to the cloud.

More IT organizations will begin this transformation as the key reasons for on-premises networks become harder to justify. This is already starting to happen, with comfort around cloud growing in some industries, notably financial services. The introduction of high-density Catalyst access points, available in the Meraki cloud management platform, and innovations in cloud-managed networks, are bringing more customization options to cloud networks.

This transformation to cloud management allows IT to support the trends described at the outset of this white paper in a scalable way. Today, with minimal disruption, IT organizations can deploy cloud monitoring from Cisco Meraki for the Cisco Catalyst 9000 switching family, bringing access to real-time network data and enabling remote troubleshooting of network issues.

IT can take this journey one step further by enabling cloud management for the Cisco Catalyst 9162, 9164, and 9166 Series Access Points with the Cisco Meraki cloud management platform.

This solution migrates the hardware from Catalyst Center to the Meraki cloud management platform. With this migration, an on-premises network management system is no longer needed to support the network.

The IT operating model from Cisco is scalable and flexible, encompassing both on-premises and cloud network management, and features converged hardware that works regardless of the management platform. IT teams can transition to the cloud when they are ready and protect their technology investments by not having to rip and replace hardware.

Networking is changing fast, and the Cisco IT operating model is built to help IT teams in financial services keep up by delivering a scalable, consistent experience as they journey to cloud network management. With cloud network monitoring and management from Cisco, IT and OT organizations can be more proactive, flexible, and responsive. They can worry less about how the network is managed and spend more time focusing on projects that directly contribute to business success.

Watch a demo of Catalyst and Meraki, together

Learn more about access networking

[3] "61% of FS Leaders Expect Cloud to Increase Revenue," Capco, 2022.

[4] Enterprise Management Associates, Hybrid Work Requires Network Transformation, 2022.

[5] "The Future of Cloud in 2028: From Technology to Business Necessity," Gartner, 2023.

[6] "The Deloitte Center for Financial Services Global Outlook Survey," 2021.

[7] Enterprise Management Associates, Hybrid Work Requires Network Transformation, 2022.

[9] Gartner Financial Services Business Priority Tracker, 2022.