10

Cybersecurity in ASEAN: An Urgent Call to Action

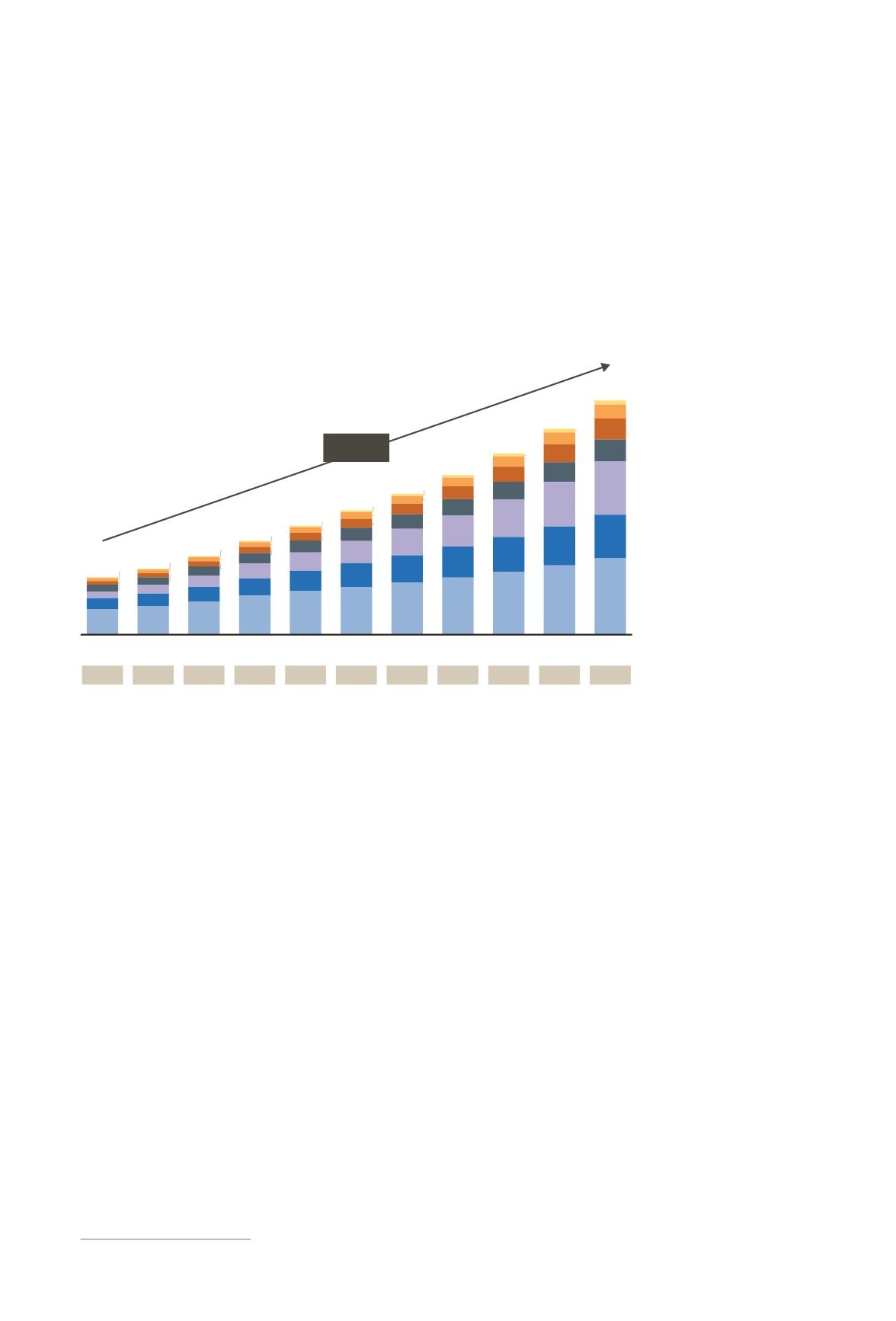

ASEAN’s cybersecurity spend was estimated to be $1.9 billion in 2017, representing 0.06 percent

of the region’s GDP. ASEAN’s spending on cybersecurity is forecasted to grow at 15 percent CAGR

from 2015 to 2025 (see figure 6). The top three economies—Singapore, Malaysia, and Indonesia—

are likely to drive a significant portion of this growth, accounting for 75 percent of the market by

2025. Indonesia, the Philippines, Vietnam, and Malaysia are expected to see the highest growth as

they address gaps in infrastructure and as the managed service landscape evolves.

Notes: Cybersecurity spend includes both private and public sector spend on the following: identity and access management, infrastructure protection

(including content and endpoint), and network security.

Sources: International Data Corporation, Gartner; A.T. Kearney analysis

Figure

ASEAN cybersecurity spending is expected to show double-digit growth up to

ASEAN cybersecurity spending

million

Rest of ASEAN

Vietnam

Philippines

Thailand

Indonesia

Malaysia

Singapore

+ %

CAGR

–

+%

+%

+%

+%

+%

+%

.%

.%

.%

.%

.%

.%

.%

. %

.%

.%

.%

,

,

,

,

,

,

,

,

,

,

,

%

+%

% cybersecurity spend

of GDP (ASEAN)

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

However, when benchmarking national cybersecurity spending as a percentage of GDP, most

ASEAN countries fall below the global average and well below best-in-class, creating a potential

risk of insufficient spend relative to a rapidly escalating threat landscape (see figure 7 on page 11).

14

1.3Anascent local cybersecurity industrywith shortages of

home-grown capabilities and expertise

The cybersecurity industry in the ASEAN region faces structural challenges because of its highly

fragmented nature. In addition, the shortage of skilled talent impacts the competitiveness of

the local industry.

1.3.1 Fragmentation of products offeringswith lack of end-to-end solutionproviders

The cybersecurity industry globally and in the region, is characterized by numerous products

and solutions (see figure 8 on page 11). Vendor product portfolios are varied, and few offer

solutions that cover the entire capability value chain. End users face the challenge of navigating

through a complex web of vendor relationships to design their cybersecurity programs. Despite

14

Based on cybersecurity as a percentage of spend for select global markets